Yuma County Contract for Deed Form (Arizona)

All Yuma County specific forms and documents listed below are included in your immediate download package:

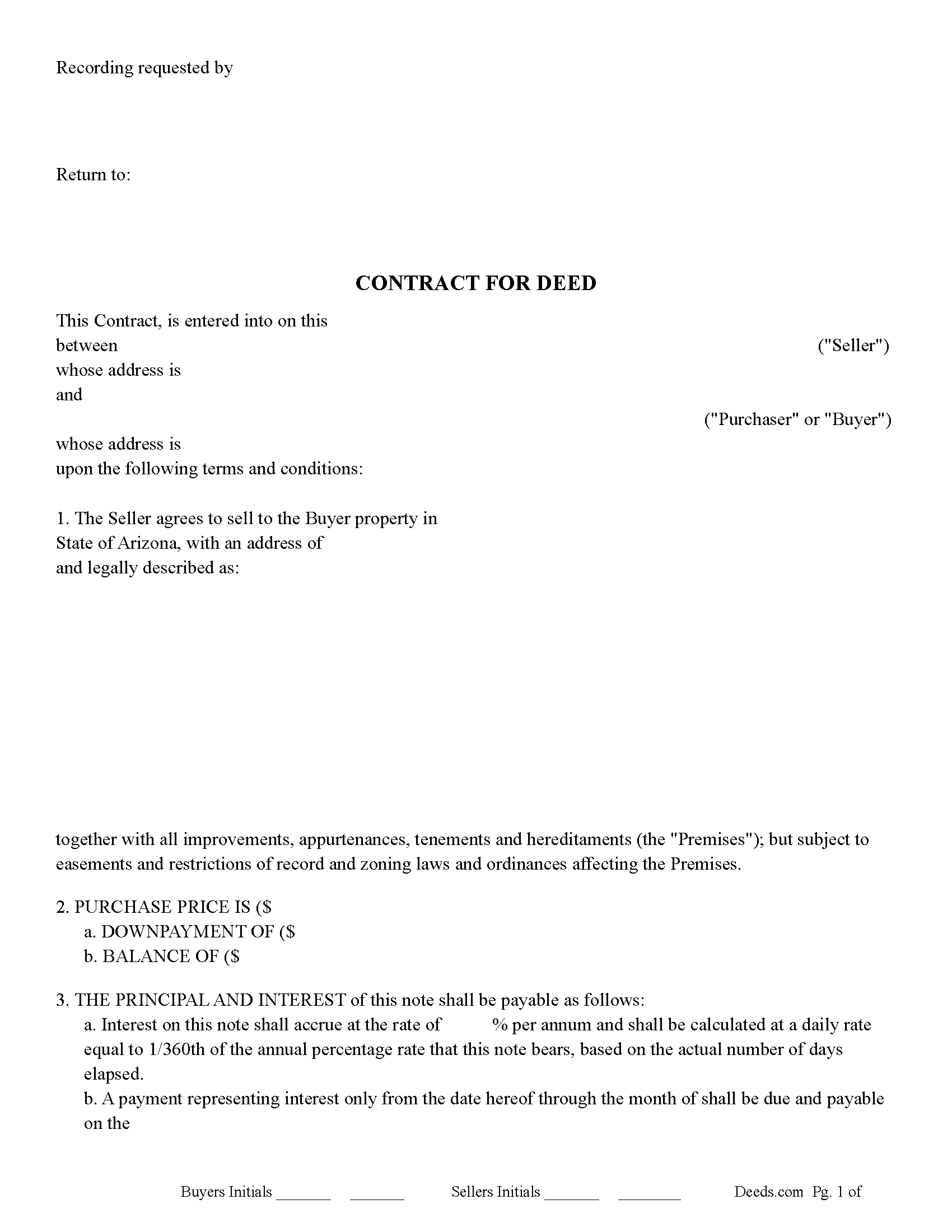

Contract for Deed Form

Fill in the blank Contract for Deed form formatted to comply with all Arizona recording and content requirements.

Included Yuma County compliant document last validated/updated 11/8/2024

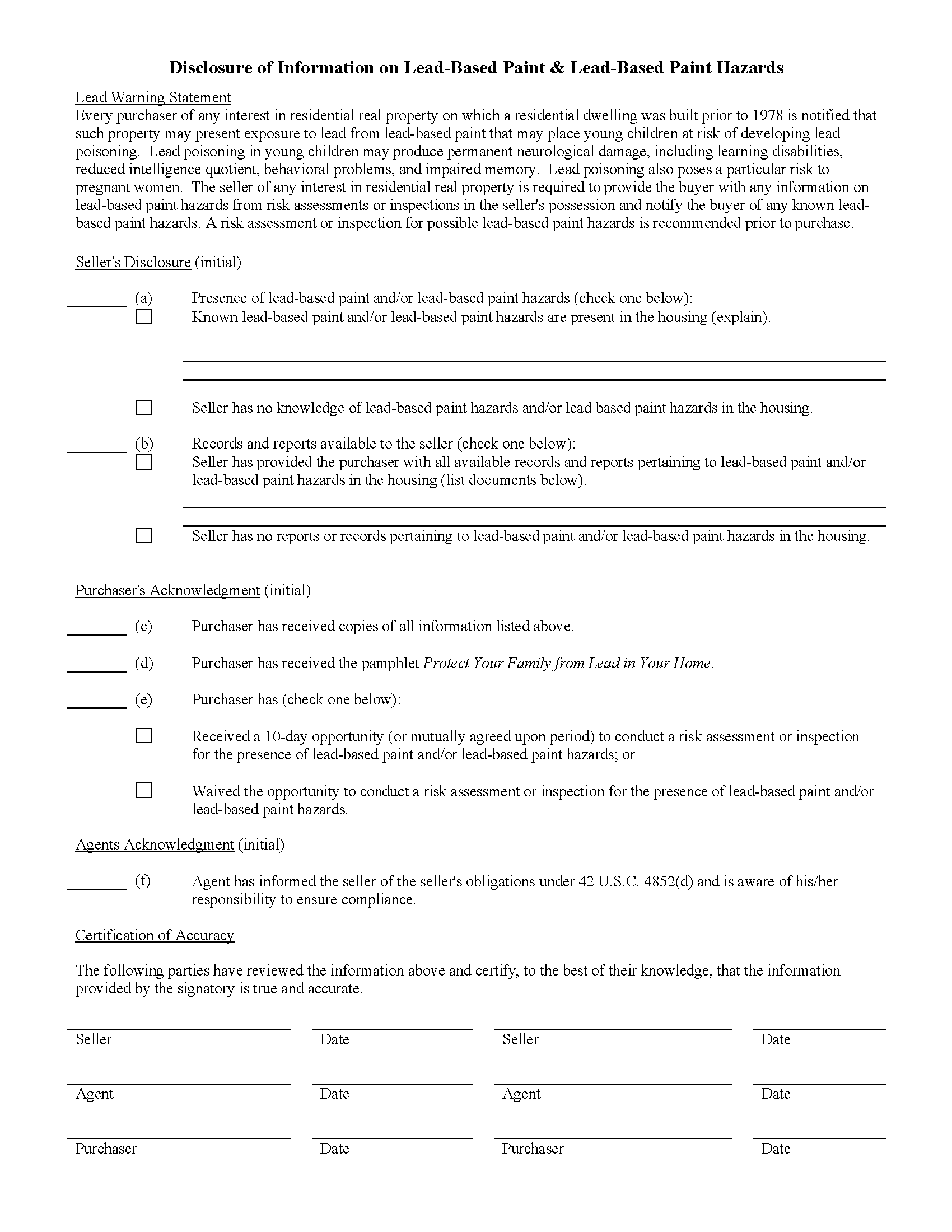

Lead Based Paint Disclosure Form

Disclosure form issued to buyer if applicable, typically residential property built before 1978

Included Yuma County compliant document last validated/updated 9/5/2024

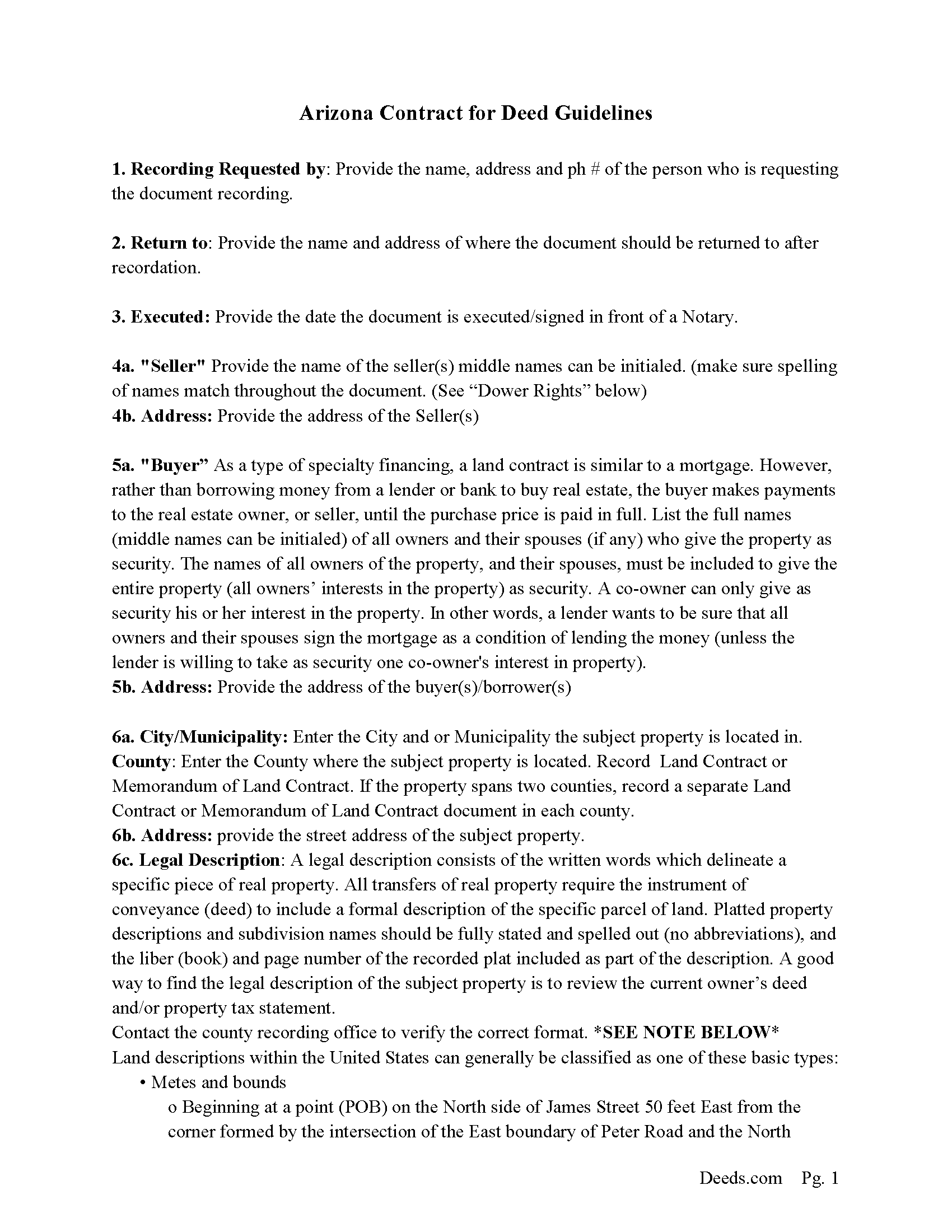

Contract for Deed Guide

Line by line guide explaining every blank on the Contract for Deed form.

Included Yuma County compliant document last validated/updated 11/19/2024

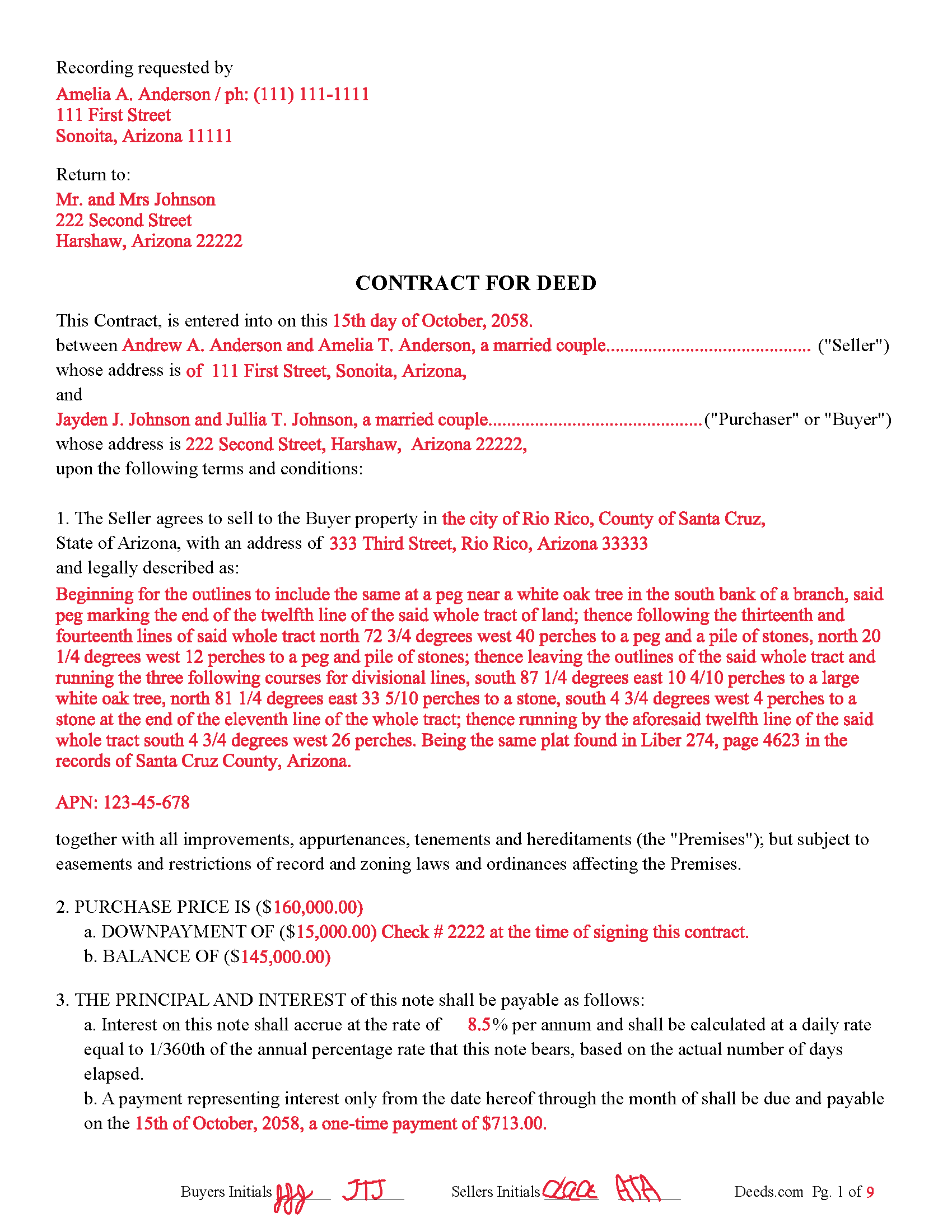

Completed Example of the Contract for Deed Document

Example of a properly completed Arizona Contract for Deed document for reference.

Included Yuma County compliant document last validated/updated 12/11/2024

Residential Sellers Property Disclosure Statement

Required for residential property.

Included Yuma County compliant document last validated/updated 10/29/2024

Protect your family from lead based paint

If applicable issue to buyers

Included Yuma County compliant document last validated/updated 12/9/2024

The following Arizona and Yuma County supplemental forms are included as a courtesy with your order:

When using these Contract for Deed forms, the subject real estate must be physically located in Yuma County. The executed documents should then be recorded in the following office:

Recorder's Office

192 S Maiden Ln, Suite B, Yuma, Arizona 85364-2311

Hours: 8:00am - 5:00pm M-F

Phone: 928-373-6020

Local jurisdictions located in Yuma County include:

- Dateland

- Gadsden

- Roll

- San Luis

- Somerton

- Tacna

- Wellton

- Yuma

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Yuma County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Yuma County using our eRecording service.

Are these forms guaranteed to be recordable in Yuma County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Yuma County including margin requirements, content requirements, font and font size requirements.

Can the Contract for Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Yuma County that you need to transfer you would only need to order our forms once for all of your properties in Yuma County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Arizona or Yuma County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Yuma County Contract for Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Arizona Revised Statutes Title 33. Property § 33-741. Definitions

1. “Account servicing agent” means a joint agent of seller and purchaser, appointed under the contract or under a separate agreement executed by the seller and the purchaser, to hold documents and collect monies due under the contract, who does business under the laws of this state as a bank, trust company, escrow agent, savings and loan association, insurance company or real estate broker, or who is licensed, chartered or regulated by the federal deposit insurance corporation or the comptroller of the currency, or who is a member of the state bar of Arizona.

2. “Contract” means a contract for conveyance of real property, a contract for deed, a contract to convey, an agreement for sale or any similar contract through which a seller has conveyed to a purchaser equitable title in property and under which the seller is obligated to convey to the purchaser the remainder of the seller's title in the property, whether legal or equitable, on payment in full of all monies due under the contract. This article does not apply to purchase contracts and receipts, escrow instructions or similar executory contracts which are intended to control the rights and obligations of the parties to executory contracts pending the closing of a sale or purchase transaction.

3. “Monies due under the contract” means:

(a) Any principal and interest payments which are currently due and payable to the seller.

(b) Any principal and interest payments which are currently due and payable to other persons who hold existing liens and encumbrances on the property, the unpaid principal portion of which constitutes a portion of the purchase price, as stated in the contract, if the principal and interest payments were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

(c) Any delinquent taxes and assessments, including interest and penalty, due and payable to any governmental entity authorized to impose liens on the property which are the purchaser's obligations under the contract, if the taxes and assessments were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

(d) Any unpaid premiums for any policy or policies of insurance which are the obligation of the purchaser to maintain under the contract, if the premiums were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

4. “Payoff deed” means the deed that the seller is obligated to deliver to the purchaser on payment in full of all monies due under the contract to convey to the purchaser the remainder of the seller's title in the property, whether legal or equitable, as prescribed by the terms of the contract.

5. “Property” means the real property described in the contract and any personal property included under the contract.

6. “Purchaser” means the person or any successor in interest to the person who has contracted to purchase the seller's title to the property which is the subject of the contract.

7. “Seller” means the person or any successor in interest to the person who has contracted to convey his title to the property which is the subject of the contract.

33-742. Forfeiture of interest of purchaser in default under contract

A. If a purchaser is in default by failing to pay monies due under the contract, a seller may, after expiration of the applicable period stated in subsection D of this section and after serving the notice of election to forfeit stated in section 33-743, complete the forfeiture of the purchaser's interest in the property in the manner provided by section 33-744 or 33-745. If the contract provides that the seller may elect to accelerate the principal balance due under the contract to the seller on the purchaser's failure to pay the monies due, the seller may accelerate the principal balance due to the seller at any time after the purchaser has failed to pay the monies due under the contract. The acceleration may occur before or after the expiration of the applicable period stated in subsection D of this section and without serving the notice of election to forfeit stated in section 33-743. If the seller elects to accelerate the principal balance due to the seller, the seller may only foreclose the contract as a mortgage in the manner provided by section 33-748. If a purchaser is in default under the contract for reasons other than failing to pay monies due under the contract, the seller may only foreclose the contract as a mortgage in the manner provided by section 33-748.

B. The interest of a purchaser in any personal property included in a contract is subject to forfeiture or foreclosure in the same manner as the real property, except that forfeiture or foreclosure does not affect or impair the rights of a holder of a security interest whose interest in the personal property is not subordinate to that of the seller.

C. If a contract provides that time is of the essence, a waiver of that provision occurs only if the seller has accepted monies due under the contract in an amount which is less than the total monies due under the contract at the time of the acceptance. Receipt of any monies due under the contract by an account servicing agency does not constitute acceptance by the seller. A seller's delay in exercising any remedy granted either by the contract or by law does not constitute a waiver of a time is of the essence provision. If the time of the essence provision has been waived, the seller may reinstate the provision by serving a written notice on the purchaser and the account servicing agent, if one has been appointed, requiring strict performance of the purchaser's obligations to pay monies due under the contract. The notice shall be served, either by delivery in person or deposit in the United States mail, first class, postage prepaid, at least twenty days prior to the date on which the seller will require the purchaser to pay the monies due under the contract. A copy of the notice need not be recorded in the county in which the real property is located or served on any person other than the purchaser and the account servicing agent, if one has been appointed.

D. Forfeiture of the interest of a purchaser in the property for failure to pay monies due under the contract may be enforced only after expiration of the following periods after the date such monies were due:

1. If there has been paid less than twenty per cent of the purchase price, thirty days.

2. If there has been paid twenty per cent, or more, but less than thirty per cent of the purchase price, sixty days.

3. If there has been paid thirty per cent, or more, but less than fifty per cent of the purchase price, one hundred and twenty days.

4. If there has been paid fifty per cent, or more, of the purchase price, nine months.

E. For the purpose of computing the percentage of the purchase price paid under subsection D of this section, the total of only the following constitutes payments on the purchase price:

1. Down payments paid to the seller.

2. Principal payments paid to the seller on the contract.

3. Principal payments paid to other persons who hold liens or encumbrances on the property, the principal portion of which constitutes a portion of the purchase price, as stated under the contract.

Use this form for the sale of residential property, vacant land, condominiums, rental property and planned unit developments.

Our Promise

The documents you receive here will meet, or exceed, the Yuma County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Yuma County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4446 Reviews )

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Muhamed H.

February 3rd, 2022

Nice!

Thank you!

Helen D.

July 27th, 2020

I was just trying to look up a record.

Thank you for your feedback. We really appreciate it. Have a great day!

Lori C.

November 15th, 2019

It just a little disconcerting that I was not able to preview any of the forms prior to purchasing them. Thank goodness they were the correct forms I needed. I would suggest being able to at least make the picture of the forms a little larger or give the capability to zoom in.

Thank you!

Therese L.

September 20th, 2019

Good instructions and example

Thank you!

Theresa M.

June 5th, 2020

Deeds.com was simple to use and had a quick turnaround. Saved me so much time hunting around on the internet and recorder's office website to try and figure out the process. would definitely use again!

Thank you!

Ron D.

January 14th, 2019

No choice since the county does not seem to provide info you supplied.

Thank Ron, have a great day!

Kendall B.

September 24th, 2019

Good

Thank you!

Phoenix D.

August 17th, 2020

I was looking for the proper quit claim deed for my state. I found it on deeds.com along with instructions and a sample. I couldn't have filed without them.

Thank you for your feedback. We really appreciate it. Have a great day!

Paulette O.

March 24th, 2021

I love this! I wish there was one for a simple personal will.

Thank you!

Jim P.

August 8th, 2022

Exactly what we were looking for and filled out everything in minutes. Great value!

Thank you!

george k.

March 6th, 2019

Thank u the site helped me get the quick deed forms I needed for TN.i will use it in the furture.

Thank you for your feedback. We really appreciate it. Have a great day!

Lawrence R.

February 4th, 2020

Forms do not allow enough space for fields and cutoff. Need to expand the fields to allow for more writing. I ended up re-typing to be able to include full property description.

Would be nice if available in Word format rather than only PDF format.

Thank you for your feedback. We really appreciate it. Have a great day!