Kenai Peninsula Borough Transfer on Death Deed Form (Alaska)

All Kenai Peninsula Borough specific forms and documents listed below are included in your immediate download package:

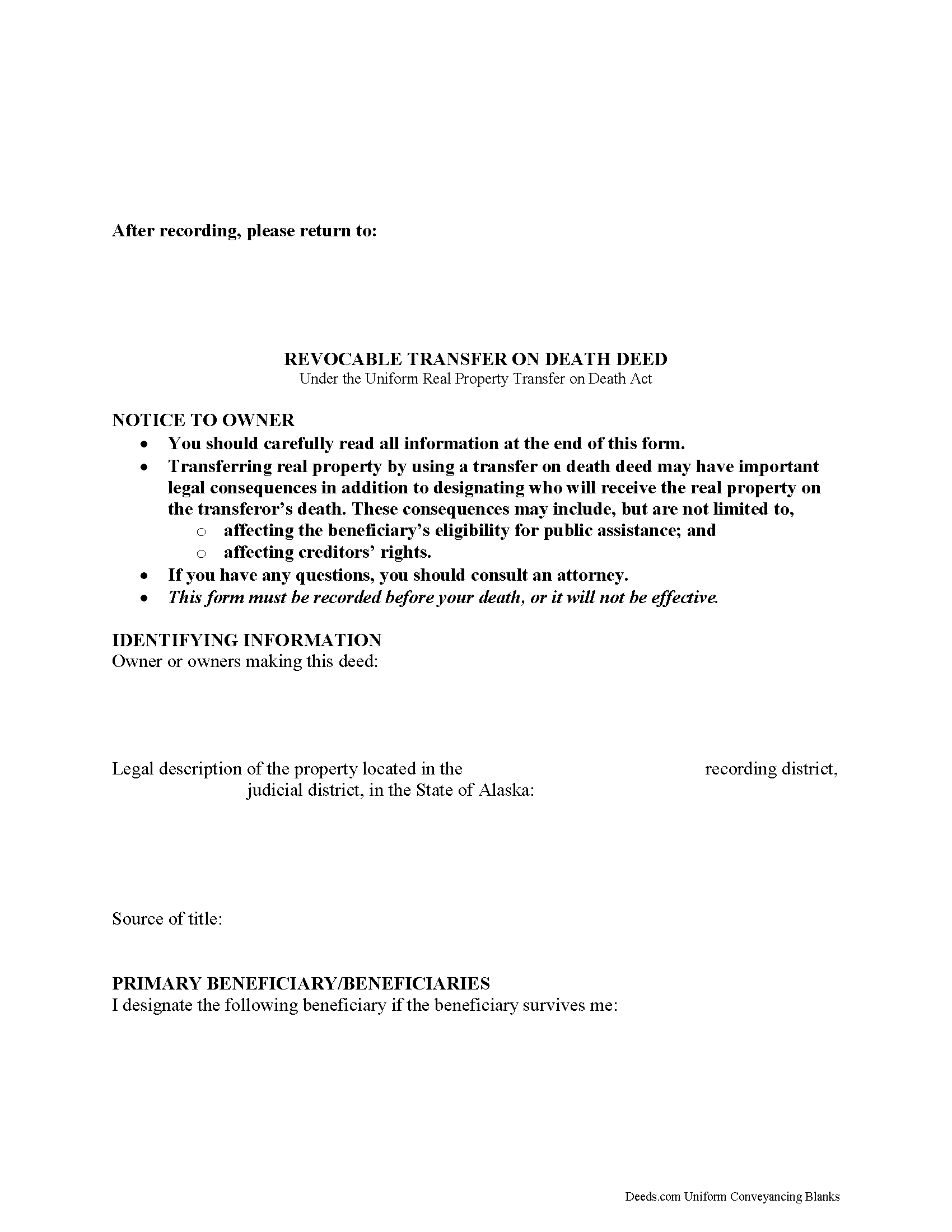

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Kenai Peninsula Borough compliant document last validated/updated 11/13/2024

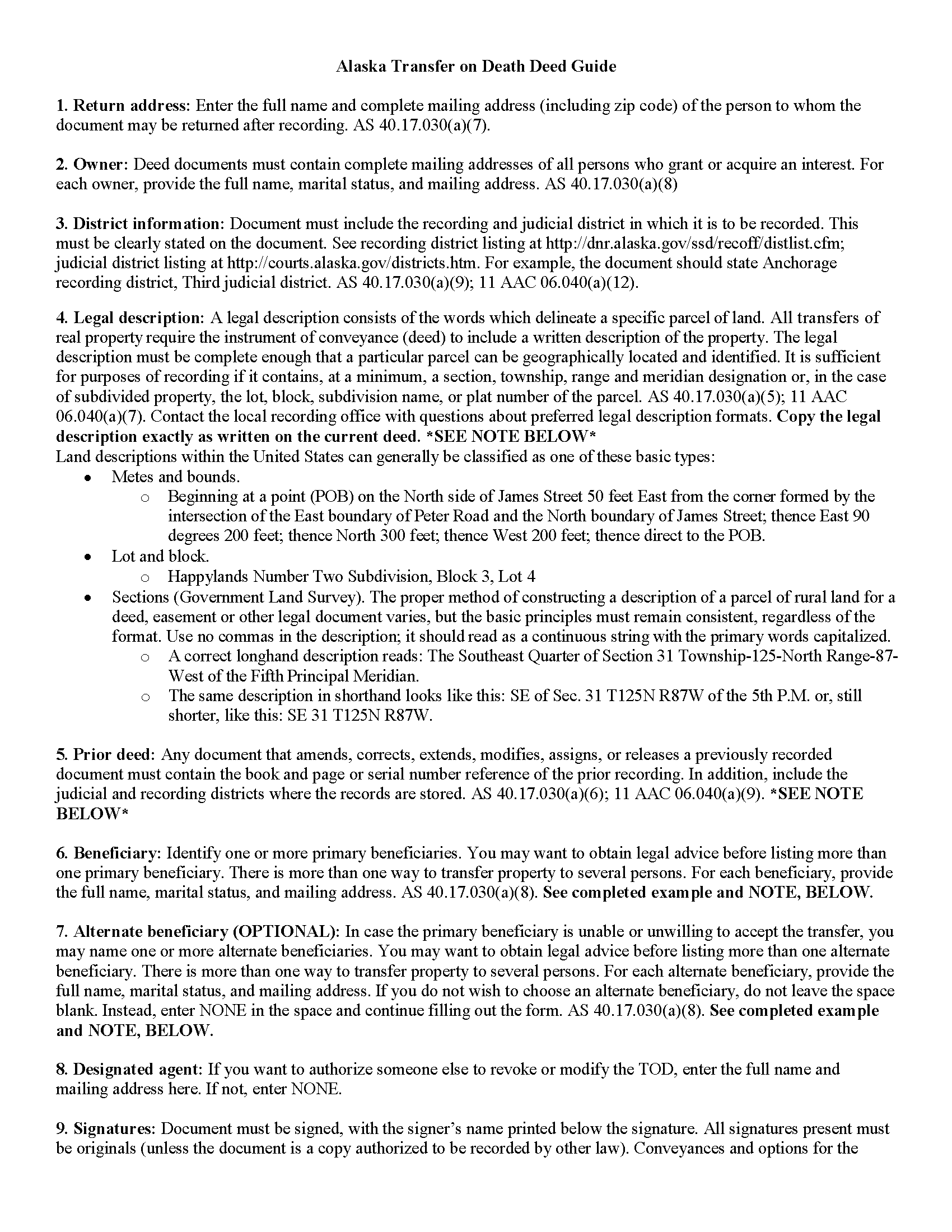

Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

Included Kenai Peninsula Borough compliant document last validated/updated 12/19/2024

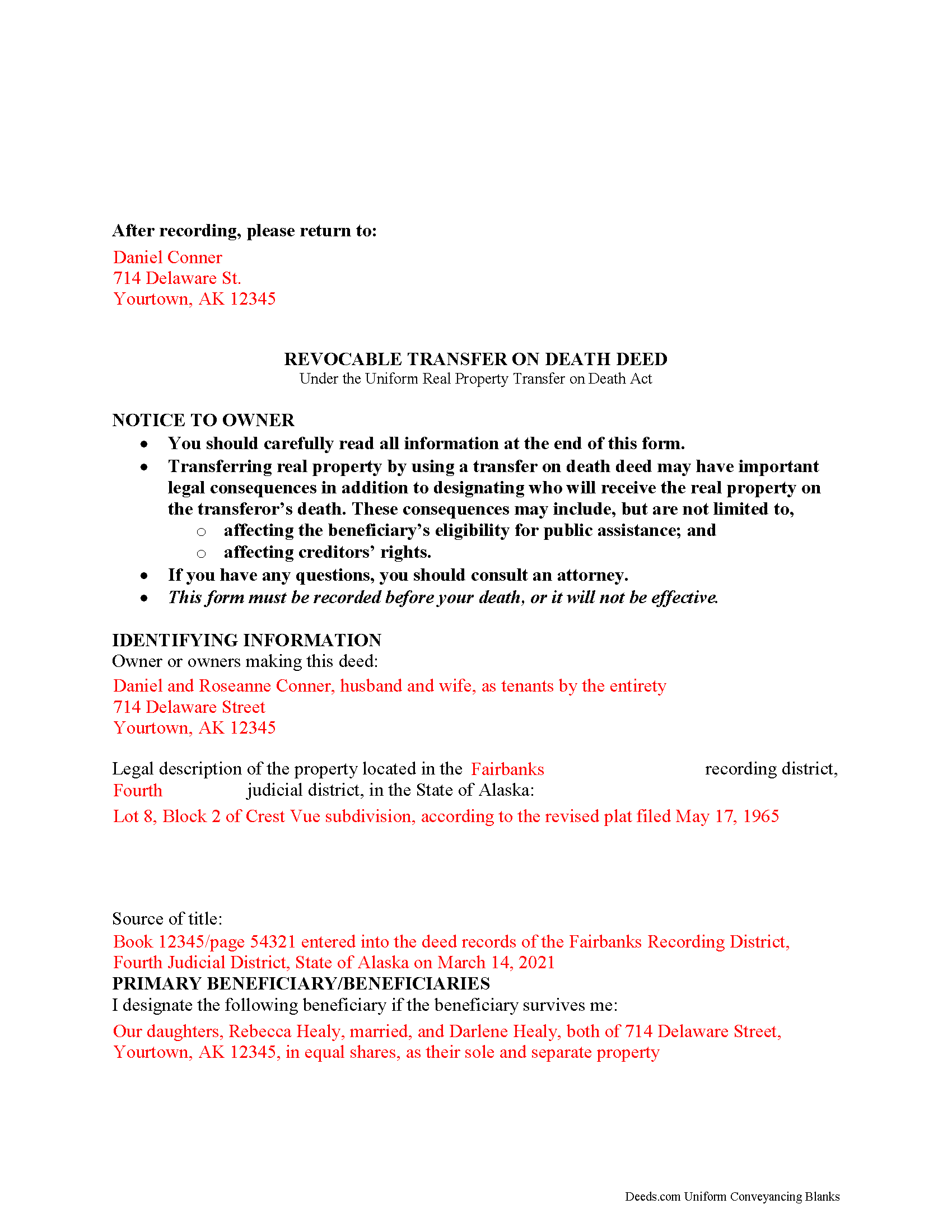

Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

Included Kenai Peninsula Borough compliant document last validated/updated 12/6/2024

The following Alaska and Kenai Peninsula Borough supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Kenai Peninsula Borough. The executed documents should then be recorded in one of the following offices:

Kenai Office (for Kenai District)

110 Trading Bay Rd, #190, Kenai, Alaska 99611

Hours: 8:00 to 3:30 M-F (occasional lunch closure 12:30 - 1:30)

Phone: (907) 283-3118

Anchorage Office (for Seward, Homer & Seldovia District)

550 West 7th Ave, Suite 1200, Anchorage, Alaska 99501-3564

Hours: 8:00 to 3:30 M-F / Research from 7:30

Phone: (907) 269-8872 or 269-8876

Local jurisdictions located in Kenai Peninsula Borough include:

- Anchor Point

- Clam Gulch

- Cooper Landing

- Homer

- Hope

- Kasilof

- Kenai

- Moose Pass

- Nikiski

- Ninilchik

- Seldovia

- Seward

- Soldotna

- Sterling

- Tyonek

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Kenai Peninsula Borough forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Kenai Peninsula Borough using our eRecording service.

Are these forms guaranteed to be recordable in Kenai Peninsula Borough?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kenai Peninsula Borough including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Kenai Peninsula Borough that you need to transfer you would only need to order our forms once for all of your properties in Kenai Peninsula Borough.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Alaska or Kenai Peninsula Borough. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Kenai Peninsula Borough Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Real property owners in Alaska have an estate planning option: the transfer on death deed (TODD). Find the full text in AS 13.48.

This statute is based on the Uniform Real Property Transfer on Death Act (URPTODA). By adopting the provisions of the URPTODA, Alaska joins with an increasing number of states using this law to help real estate owners manage the distribution of what is often their most significant asset -- their real estate -- by executing and recording a transfer on death deed.

Transfer on death deeds are nontestamentary, which means ownership of the property passes to the beneficiary without including it in a will or a need for probate (AS 13.48.030). Still, best practices dictate that landholders should take care to ensure that their wills and TODDs contain the same directions.

Alaska's version of the URPTODA sets out the specific requirements for lawful transfer on death deeds:

- The capacity required to make or revoke a transfer on death deed is the same as the capacity required to make a will (AS 13.48.040).

- It must contain the essential elements and formalities of a properly recordable inter vivos deed, such as warranty or quitclaim deed (AS 13.48.050(1)).

- It must state that the transfer to the designated beneficiary is to occur at the transferor's death (AS 13.48.050(2)).

- It may not use a beneficiary designation that only identifies beneficiaries as members of a class or the deed is void. (AS 13.48.050(3)).

- It must be recorded before the transferor's death in the office of the clerk of the county commission in the county where the property is located (AS 13.48.050 (4)).

The named beneficiary gains no present rights to the property, only a potential future interest. Instead, the transferors retain absolute control during their lives. This includes the freedom to sell or transfer it to someone else, and to modify or revoke the intended transfer on death (AS 13.48.080). These details, along with the fact that TODDs only convey the property rights remaining, if any, at the owner's death, explain why they do not require notice or consideration (AS 13.48.060).

According to AS 13.48.090, the beneficiary gains equitable interest in the property ONLY when the owner dies. Note, however, that the beneficiary must be alive at the time of the transferor's death or the interest returns to the estate. To prevent this from happening, the owner may identify one or more contingent beneficiaries. All beneficiaries take title subject to any obligations (contracts, easements, etc.) associated with the property when the transferor dies (AS 13.48.090(b)).

If a beneficiary is unable or unwilling to accept the transfer when the owner dies, AS 13.48.100 includes the option to disclaim all or part of the interest as provided under AS 13.70 (Uniform Disclaimer of Property Interests Act).

With these new transfer on death deeds, real property owners in Alaska gained access to a convenient, flexible tool for managing one aspect of a comprehensive estate plan. Even so, a TODD may not be appropriate for everyone. Since each situation is unique, contact an attorney with specific questions or for complex circumstances.

Our Promise

The documents you receive here will meet, or exceed, the Kenai Peninsula Borough recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kenai Peninsula Borough Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4445 Reviews )

Dennis F.

December 20th, 2024

The release of mortgage form was OK, and accepted at the recorder's office, but there were some problems. Many of the fields to type in were too small to accept the data, and I could not find a way to change the field size or use a smaller font. Otherwise I was satisfied.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds.rnrnFrazer Walton, Jr.rnLaw Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William S.

June 26th, 2022

The forms worked well for entering information. I have finished without much trouble. Since the forms are Adobe PDF files you need the free app to use them but you can't edit unless you have the paid Adobe program. And, it was a reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathy O.

December 2nd, 2021

I was so happy to be able to print the Quit Claim Deed form and learn about other forms. Very pleased with this service! Took the stress out of preparing needed deeds for notirization for our Trust. Very grateful. Thank you. Kathy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wendy B.

December 20th, 2019

Really appreciate you he quick response and solution to my problem!!

Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Fabio S.

May 27th, 2020

Fast, Easy and with great assistance!

I will definitely use their services again!

Thank you for your feedback. We really appreciate it. Have a great day!

HAROLD V.

April 2nd, 2020

Great website to have your buyer's deeds done correctly! I highly recommend this website to anyone in the real estate business.

Thank you!

FE P.

March 4th, 2023

Looked into a good number of DIY deeds on the internet. Very glad that I chose Deeds.com. They made it easy to make your own deed based on your state and the process based on the sample included was easy to follow. Also the cost was very reasonable. Great company.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

barbara m.

March 16th, 2021

deeds.com is the most efficient, easy to use site for legal forms I've found! Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David C.

January 17th, 2020

Very fast service

Thank you!

Robyn D.

July 28th, 2020

Excellent service, knowledgeable and helpful representatives via the messaging service. Reliable information provided by reps, overall excellent experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Amy S.

March 7th, 2022

So convenient! I love this service. I highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shirley T.

April 14th, 2021

Quit Claim deed for North Carolina did not include all of the information I needed (two separate notary sections), but I was able to re-create another notary section in Word, and then insert it in the appropriate place after printing both documents. Otherwise, the document worked as described.

Thank you for your feedback. We really appreciate it. Have a great day!

Petti V.

February 15th, 2022

Your site was so easy to use. And I got the form and instructions I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!