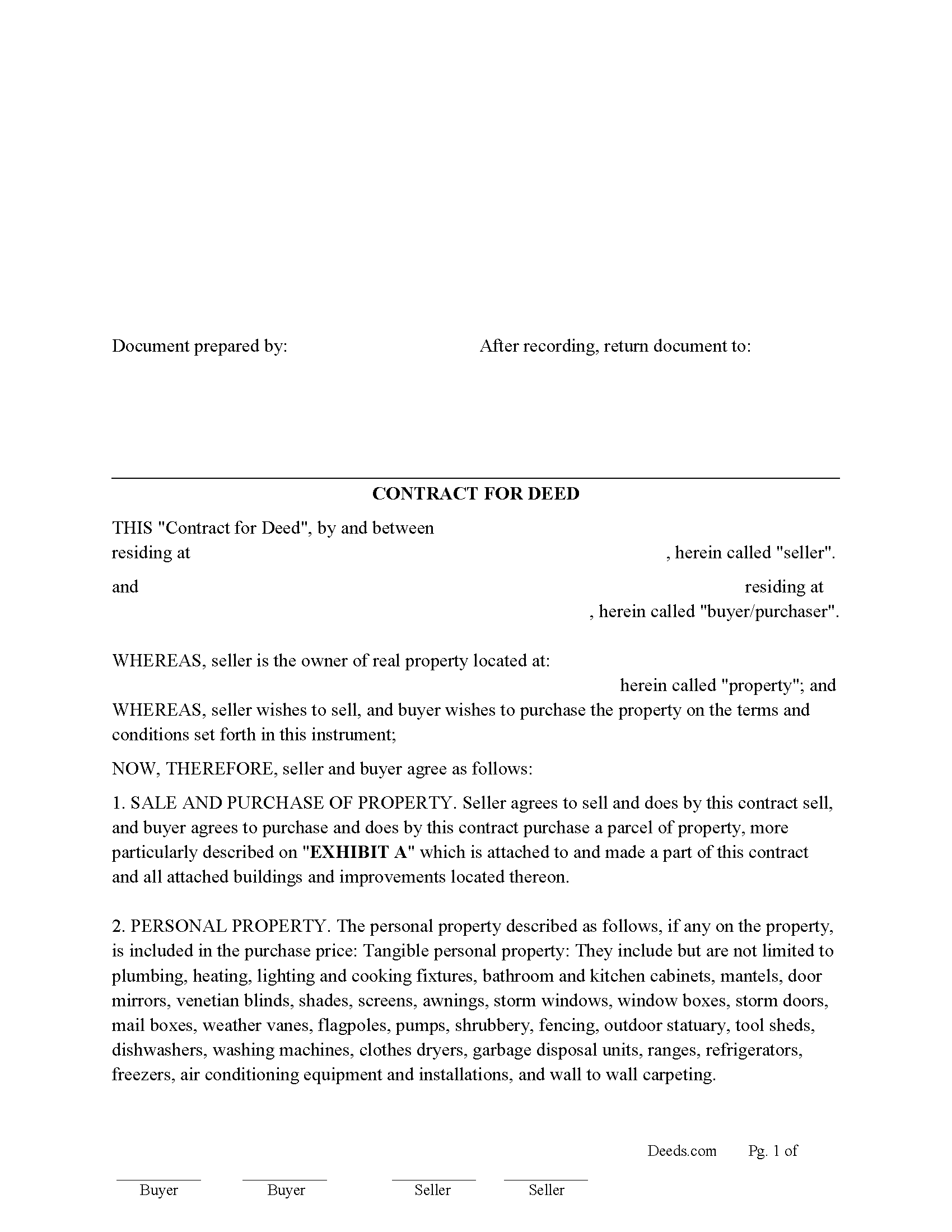

Download Alabama Contract for Deed Legal Forms

Alabama Contract for Deed Overview

A contract for deed, also known as a land contract or installment sale agreement, is an alternative financing arrangement for buying property, where the seller finances the purchase rather than the buyer obtaining a loan from a third-party lender. In Alabama, as in other states, this type of contract involves the buyer making payments directly to the seller over a period until the full purchase price is paid, after

1. Seller Financing: The primary function of a Contract for Deed is to provide an alternative financing option where the seller acts as the lender. The buyer makes payments directly to the seller over an agreed-upon period instead of obtaining a loan from a bank or mortgage company.

2. Transfer of Ownership: Unlike traditional real estate transactions where ownership is transferred immediately upon the close of the sale, in a Contract for Deed, the legal title remains with the seller until all payments under the contract have been completed. This deferred transfer of title is a distinctive feature of this type of agreement.

3. Possession and Use: Although the legal title remains with the seller, the buyer usually takes possession of the property right after the contract is signed. The buyer can use the property, live in it, or even improve it during the term of the contract.

4. Payment Structure: The payments made under a Contract for Deed often resemble those of a standard mortgage, including principal and interest, and are typically made in monthly installments. This contract also includes a balloon payment option if applicable to your situation.

5. Protection for Both Parties: The contract specifies the obligations and rights of both the buyer and the seller, providing protections for each: THE PURCHASER CAN CURE A DEFAULT in the Note by bringing all past due payments on the Note and penalties, if any, current. If the Note is subject to foreclosure, the Purchaser would, most likely, be required to pay the entire balance due under the Note to protect the Purchaser's interest in the Property.

6. Flexibility: Contracts for Deed can be customized to suit the financial situations and agreements between individual buyers and sellers, Use this Contract for residential property, rental units, and condominiums.

Sections 40-22-1 through 40-22-12 of the Code of Alabama 1975 pertain to the recordation of conditional sale contracts, which include contracts for deed or installment sale agreements. These provisions outline the legal requirements for recording such contracts to ensure they are valid and enforceable, as well as to provide public notice of the buyer's interest in the property.

1. Requirement for Recordation: Mandatory Recording: To be enforceable against third parties, a conditional sale contract must be recorded in the office of the judge of probate in the county where the property is located. This recording provides public notice of the buyer's equitable interest in the property.

2. Timeframe: The contract must be recorded within a specific timeframe (often within 30 days of execution) to ensure it is properly indexed and accessible for public record.