Tag: credit profile

-

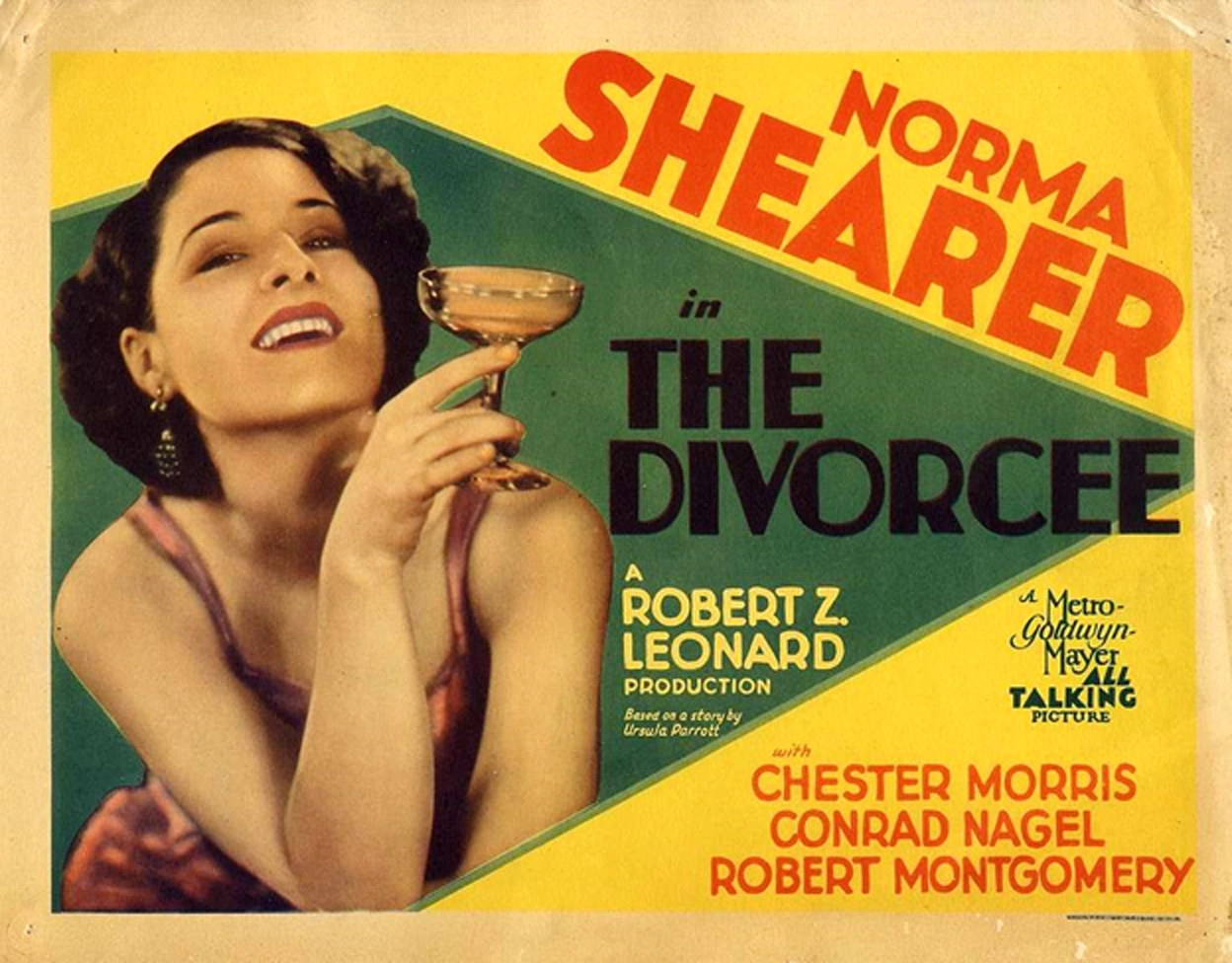

Divorced and Looking (For a House)

If you’re newly separated or divorced, you could be shopping for a home. Letting go of the home you shared with your former partner leads to a series of steps: from the deed you shared, to a new deed. A deed to a home of your own. Here, we spot the issues for the newly…

-

All About DTI: How Much Debt Is Too Much If I Want to Buy a Home?

Receiving the deed to a home is a major milestone. Typically, it depends on an earlier milestone: the mortgage approval. Apply for a mortgage, and lenders will consider your debt-to-income ratio (DTI). Why the DTI? Essentially, the lender wants to know how much of your earnings you spend, using credit. A low DTI suggests that…