In the Adirondacks and Beyond…

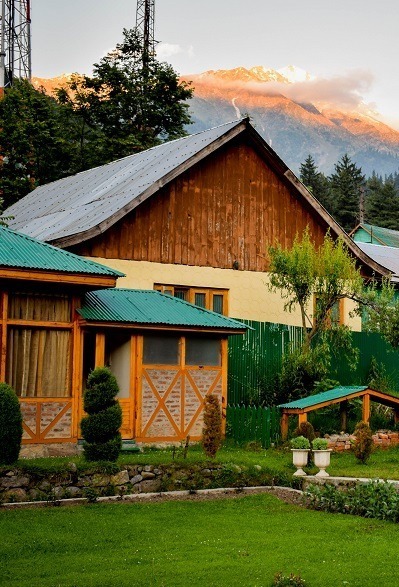

Jobs around Lake Placid and Saranac Lake are plentiful these days. There’s just one hitch. Prospective takers can’t find accessibly priced housing. Around these scenic Adirondack towns in northern New York, affordable units are few and far between. In Lake Placid, the Mohawk Valley Land Bank is working to remedy the situation by offering reliable workforce housing.

And other land banks are on the rise just about everywhere. Let’s take a look.

The Housing Need Is Urgent

Much of the real estate here turns into vacation homes. And many of the homes that could be lived in have seen better days and need renovations. There aren’t enough new units coming into the market to keep a local workforce housed.

At the same time, all of Upstate New York has seen an influx of people moving here from the cities. Visitors love the area and its outdoor beauty, too. Vacationers want to enjoy the recreational offerings that the Adirondacks are known for. And that makes it all the more important to meet the housing needs of locals.

Businesses sense the opportunities. They are investing in real estate that appeals to the short-term rental market. And this just drives the price of housing up.

It’s Time for Action

Desperate times call for creative measures. Here are some leading options for Northern New York:

Land Bank Model

A group called ADKAction is currently planning a new land bank for the Adirondack region. What’s a land bank? It’s a charitable corporation that receives federal and local government support to purchase foreclosed or vacant lots and buildings. Once it renovates and starts selling the real estate, it can really take off as a self-sustaining source of revenue and a viable source of area housing.

Historically, land banks have worked their makeover magic in distressed areas. The state gives them special abilities to wipe out tax liens. Ever since the advent of the pandemic, policy makers are seriously looking at land banks as viable players in restoring local economies.

What are the biggest challenges in creating a land bank? Mainly, it’s about educating investors and a community on how it works. A lot rests on understanding the legal points of forming the entity, and clearing the tax liens from the target properties’ titles.

Co-Ops and Deed Restricted Resort-Area Homes

Co-op housing is another model. Some groups receive donations of land. And some of that land could become nonprofit co-op property. It would be owned and managed by residents who rent their units from the collective.

☛ Do co-op residents hold the titles to their units? Here’s how a housing co-op works.

And then there’s the potential for deed-restricted homes — to keep a scenic area’s real estate from being snapped up for short-term rentals. The group LivingADK is replicating the Vail InDEED deed-restriction model to keep homes as primary residences of present and future buyers. Deed-restricted units sell for less than what investors are bidding — but buyers are compensated for the choices they agree to give up.

LivingADK is now seeking potential sellers: people hoping to downsize, or people who need the cash incentive.

Land Trust Model

Land trusts are an additional tool. U.S. land trusts emerged when Georgia’s Black farmers created trusts for people who would share the equity. Today, there’s the Community Land Trust (CLT), working in major markets including Atlanta, Nashville, Austin, Indianapolis, and Denver.

Could it work in the resort towns of the Adirondacks? Sure! Just look at Vermont, with its Champlain Housing Trust — a sprawling collective of rentals, houses, condos, and co-ops.

CLTs are nonprofits, usually run by a board, staff, and the residents, supported by membership dues, developer fees, and federal funds. To buy in, a person gets a home loan for a restricted ownership interest in the property. Should the owner wish to sell, the unit has to remain as affordable housing. The deed for a land trust home is a general warranty deed, but selling is done through a Deed for Sale of Improvement Only. It transfers title only to the structure, not the land.

Land trusts are stable settings for local people to improve their financial situations.

Land Banks + Land Trusts: A Growing Synergy

What about a combined model?

Land banks and community land trusts are different animals. Land banks work with municipalities to buy distressed properties, hold them, tax-free, to renovate them, and then return them to taxable use. In contrast, community land trusts (CLTs) aren’t looking to buy property so much as promote lasting ownership for people. Especially for people In minority groups, who traditionally could only apply for a regular mortgage or keep paying rent.

But a blended approach is becoming a thing in several major markets:

- Atlanta, GA: Atlanta aims to have 5,600 new workforce housing units by 2030. The Atlanta Land Trust (ALT) is pitching in, working with Fulton County’s land bank.

- Houston, TX: The Houston Land Bank works with the local land trust on the New Home Development Program. They offer deep discounts to buyers with modest incomes. The buyers get homes; the Houston Community Land Trust gets the land. While the median freestanding home costs around $250,000, this Houston partnership helps people buy houses for under 100K.

- Richmond, VA: Virginia’s Land Bank Entities Act lets existing nonprofits, like the Maggie Walker Community Land Trust, work as land banks. Then they can buy and accept donations of land, and even get foreclosed homes for as little as $2,000. They refurbish the homes and sell them back into the market at about a third off the median market price.

- Portland, OR: Proud Ground, a CLT with 350 units, wants to become a land bank to buy more real estate, under the Oregon Land Bank statute. Portland’s land trust model empowers owners who ultimately sell to get back what they paid on their loan principal, their major upgrade costs, and 25% percent of the rise in the market value.

Meanwhile, Back in New York State…

Albany County plans to link its land bank and community land trust, through an initiative called Inclusive Neighborhoods. The land bank sells homes to the land trust at a discounted price. By state statute, purchases are made for social benefit (permanent affordable housing) — so selling for full market value is not required. People who are struggling in today’s economy and want stability will have opportunities to live and raise their kids in high-value areas through this initiative.

In Atlanta, ALT hosts sessions to explain the community land trust model to agents and potential buyers, and has even formed a task force to understand the community’s needs and preferences.

And in the Adirondacks, ADKHousing (the “Forever Affordable Adirondack Community Housing Trust”) is calling for applicants to buy homes. It’s now working on multiple initiatives to help people of modest means get housed.

What the Future Holds

Nationwide, more than 250 land banks exist. And by merging their strengths, land banks, land trusts, and related groups are using stimulus money to buy properties and guard affordability.

Oregon’s Grounded Solutions is forming a national network of collaborators, aiming to protect affordability for a million homes. And the Center for Community Progress formed the National Land Bank Network to rise to the occasion. The NLBN explains the rise of the land bank role plainly:

These governmental entities have helped transform neighborhoods in places like Detroit, Michigan; Syracuse, New York; Dallas, Texas; and Macon, Georgia that face widespread vacancy stemming from economic changes, natural disasters, and other events.

Impressive. They’re popping up everywhere now. It’s a very tough market out there, so it’s good to know that the regular style of homeownership is not the only option for today’s buyers!

Supporting References

AdirondackExplorer.org: Communities Develop Solutions to Keep People Sheltering in Place (Jul. 2, 2022).

Deeds.com: What Is a Land Trust? The Land Trust Approach to Affordable Housing (Jul. 29, 2019).

Emma Zehner for the Lincoln Institute of Land Policy: Opening Doors Land Banks and Community Land Trusts Partner to Unlock Affordable Housing Opportunities (Oct. 7, 2020; internal citations omitted).

And as linked.

Photo credits: James Wheeler and Aashish Bhardwaj, via Pexels.