The question is more loaded than you might think.

Almost every buyer finds something amiss in the home after taking the keys. A few minor things here and there? No big deal. But often, the problems are far more than a buyer bargained for.

And some home sellers know exactly what the buyers will find.

Let’s get down to the nitty-gritty on seller disclosures — or the lack thereof.

Survey Says…

When Cinch Home Services surveyed hundreds of home sellers and buyers on problems with their homes, the National Association of REALTORS® noticed. Overwhelmingly, sellers who responded to the survey admitted to selling a home with an issue the buyer didn’t know about — or an issue that was more trouble than the buyer knew. To be specific:

- 95% of buyers came across problems with their new-to-them homes. And 94% of sellers acknowledged that those issues were there — but they’d kept quiet.

- 81% of the home sellers said they’d probably behaved in ways that could be deemed unethical.

- Three-fourths of the sellers admitted that they quickly patched over or otherwise concealed problematic flaws — even though state laws might disallow what they did.

- In many cases, it was the real estate agent who told the seller to keep the issues under wraps — even though professional ethics rules warn agents against misleading people involved in a transaction.

Many problems stemmed from sellers making repairs or upgrades without permits. In a tough economy, when contractors are hard to get, and materials are costlier than ever, buyers should be on their guard.

Buyers Left Holding the Bag

If a flaw in the home is passed off to the buyer without disclosure, the buyer is stuck spending time and money on the repairs. Problems can be dangerous if they’re not found and fixed, and costly if they are.

And today’s home buyer might be stretched thin. Most buyers in the survey said they were short on funds after they bought their homes. About three-fourths reported having to find new income sources or go without certain things.

Needless to say, a big, unexpected home repair is just about the last thing these new owners needed. In the worst-case scenarios, the new homeowners regretted closing on their homes. And there were quite a few of these. Four in ten buyers said the problems they found led them to have second thoughts about their decision to buy.

That’s bad for the buyers, and bad for the industry as a whole. So the real estate trade group has good reason to be concerned. And we know our readers do, too.

☛ Concerned about getting a home that needs too much work? Can you cover the cost of surprise damages? Here’s more on how to buy a home without remorse.

Waiving the Home Inspection?

Buyers learn a lot about homes and how their systems work by following the inspector around the house. Plus, they get opportunities to negotiate with the seller based on the results of a professional home inspection.

Without going through the home and seeing what the inspector sees, and receiving that professional’s report before closing, the buyer will likely just have to take the seller’s responses to a boilerplate disclosure form at face value. No matter how many people might be vying for a particular house, skipping the inspection is just never a good thing.

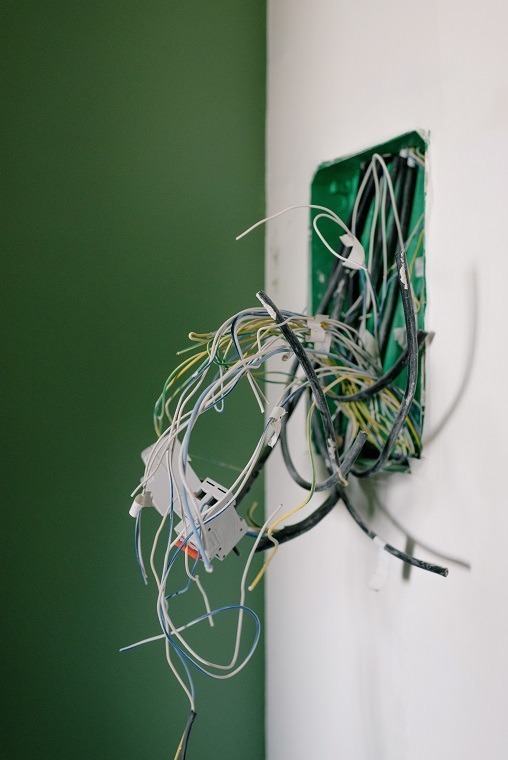

What are the main issues a new homeowner could, inadvertently, buy into? Judging by the survey, the most common issues are faulty wiring or plugs, problems with light fixtures, plumbing troubles, exterior wall issues and leaks, and evidence of water damage. Older appliances and HVAC systems, as well as roof damage or the impact of age on a home’s structure, are common too. (New homeowners should look up the Inflation Reduction Act of 2022. It provides significant tax rebates for energy-efficient systems, such as heat pumps for heating and cooling.)

What is a helpful alternative to a flat-out waiver of the inspection(s)? NAR suggests agreeing with the seller that you won’t insist on any trifling repairs. You might agree to handle anything, say, that will cost under $500 to fix. That way, the seller will know you don’t intend to exploit the contingency unreasonably.

Melissa Dittmann Tracey of REALTOR® Magazine suggests:

Buyers also could agree to request repairs only for major issues like radon or a faulty foundation, which gives them some legal recourse if they find a larger problem after moving in.

Seller Disclosure Forms Are State Matters

Different strokes for different states, but here’s the usual rule. Unless the deed to the home is being conveyed through a court or sheriff’s sale, the buyer should get a disclosure form from the seller.

It’s important to insist on getting a seller’s disclosure, so that you have recourse to state disclosure protections. Some states let buyers back out of deals (sometimes, with reimbursement for costs and fees) when the home has defects and no seller disclosure form appears by the closing date.

☛ How does an issue rise to the level of needing disclosure? Read all about it in this article: Defining “Material Defects” in the Seller’s Disclosure.

If you’re not getting a disclosure form, a thorough inspection is a must. The most thorough inspections use special technology to detect toxins and moisture. They inspect ductwork and systems behind walls. They are well versed in building techniques, land sloping, and so on.

Now, About That Survey…

Cinch Home Services is selling home warranty packages. It’s a company with an interest in finding that new buyers will need home repairs. Nevertheless, if it’s something the industry is discussing and advising its professionals to review, then it’s worth noting. A word to the wise could save new homeowners time, money, and aggravation. Successful homebuying takes preparation — not just for the pressure of the market, but also for the pressure of the moment.

So, speak with your agent about the contingencies in your purchase contract at the very beginning. A prepared home buyer, supported by a good agent, can succeed with a contingent offer — even in areas known as sellers’ markets.

Finally, should you need to know who’s responsible for a defect you have found in a house, condo, or other home, consult with an experienced attorney in your state. These matters are fact-specific, and also depend on statutes and case law. Once you establish an attorney-client relationship with a lawyer, you have access to legal guidance. Material on this website is offered as general information only — not as legal advice.

Supporting References

Melissa Dittmann Tracey for REALTOR® Magazine: Survey: 94% of Sellers Don’t Disclose Property Defects (Aug. 25, 2022).

Melissa Dittmann Tracey for REALTOR® Magazine: Waiving the Home Inspection: Don’t Blame Me! (Aug. 25, 2022).

Cinch Home Services: 94% of Sellers Don’t Disclose Property Defects (Jul. 21, 2022; describing survey data from 494 U.S. homebuyers and 476 sellers whose deals closed in the past year).

Ilyce Glink and Samuel J. Tamkin for The Washington Post: What If Your Home Seller Refuses to Give You a Disclosure Form? (Aug. 1, 2018).

And as linked. Photo credits: Energepic and Ksenia Chernaya, via Pexels.